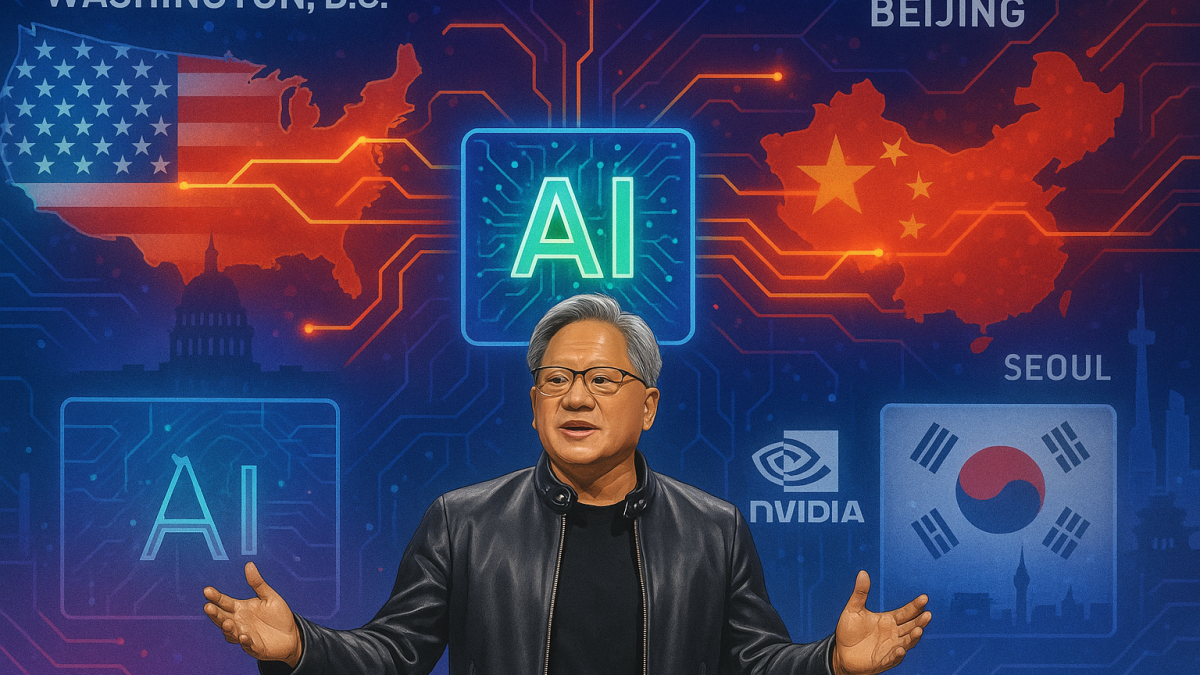

Nvidia Corp. Chief Executive Officer Jensen Huang launched a highly anticipated keynote address in the US capital on Tuesday, as investors looked for clarity on the company’s ability to sell its advanced chips to China amid shifting trade policies.

The speech coincided with President Donald Trump’s tour of Asia and ongoing efforts to recalibrate US–China technology relations, setting the stage for potential developments that could shape the future of global semiconductor trade.

Nvidia expands government ties with GTC event in Washington

Huang addressed a packed audience at Nvidia’s GTC event, held for the first time in Washington, DC—a strategic move highlighting the company’s growing engagement with government agencies and defense contractors.

The shift from its traditional Silicon Valley venue signals Nvidia’s intention to strengthen relationships in the policy and federal technology sectors.

The event comes as Trump prepares to meet Chinese President Xi Jinping later this week, with the flow of advanced technology—particularly Nvidia’s AI chips—expected to be a key point of discussion.

Under former President Joe Biden, US export restrictions limited the sale of Nvidia’s most powerful chips to China.

While Trump initially upheld those restrictions during his second term, he reversed course in July, reopening limited access.

Huang has argued that China represents a $50 billion opportunity that is critical to funding US-based research and development, which underpins Nvidia’s competitive advantage in AI.

Strengthening partnerships across South Korea

As the US and China continue to navigate trade tensions, Huang is also working to deepen Nvidia’s presence in South Korea—Asia’s fourth-largest economy and a key player in the global semiconductor supply chain.

According to a Bloomberg report, Huang plans to unveil new contracts with major Korean conglomerates, including Samsung Electronics Co., Hyundai Motor Group, and SK Group.

The deals will support the development of AI infrastructure in South Korea and offer a reliable GPU supply to firms building AI data centers and models.

SK Group, which includes chipmaker SK Hynix Inc., is investing 7 trillion won (approximately $4.9 billion) in a new AI data center, and Nvidia’s involvement could play a significant role in its development.

The announcements are expected ahead of Huang’s appearance at the APEC CEO Summit in Gyeongju on Friday.

The timing of these partnerships aligns with Trump’s plan to sign a wide-ranging cooperation agreement with South Korea covering artificial intelligence, quantum computing, biotechnology, and 6G technology.

Navigating market shifts amid AI investment boom

Nvidia remains at the center of a global AI infrastructure boom expected to exceed $1 trillion in the coming years.

Companies such as OpenAI and Oracle Corp. are investing heavily in data centers to support next-generation AI applications.

While this surge has fueled soaring valuations and optimism, analysts have compared the frenzy to the dot-com era, warning of potential overheating given the slow pace of mainstream AI adoption.

To maintain momentum, Huang has promoted the concept of “sovereign AI,” encouraging nations to develop domestic AI capabilities.

South Korea, for instance, plans to secure 200,000 high-performance GPUs by 2030—a $3 billion effort that aligns with Nvidia’s vision.

Meanwhile, Nvidia continues to lose ground in China, where government directives have halted orders for several of its key chips, reducing its market share from 95% to effectively zero.

As Trump prepares to meet Xi Jinping later this week, investors will be watching closely to see whether Nvidia’s future access to Chinese buyers becomes part of broader trade negotiations—potentially reshaping the company’s trajectory in one of the world’s largest technology markets.

The post Nvidia CEO Jensen Huang eyes new Asia partnerships as US–China trade talks loom appeared first on Invezz