Nvidia stock price has moved sideways in the past few weeks as concerns about competition and growth continue. Still, technicals and its valuation metrics point to a resurgence in the coming weeks, potentially to a record high.

Nvidia stock price technicals points to a rebound

The daily timeframe chart shows that the NVDA stock price has formed some notable bullish catalysts in the coming weeks.

It has remained above the 100-day Exponential Moving Average (EMA), a sign that bulls remain in control today.

The stock has formed a rising broadening wedge, which is commonly known as a megaphone pattern. It is now moved to the lower side of wedge pattern, a sign that it has started to bottom.

It is trading at the 23.6% Fibonacci Retracement level, while its oscillators like the Relative Strength Index (RSI) and the MACD have continued rising in the past few weeks.

Therefore, technicals suggest that the next key resistance level to watch will be the psychological level at $200. A move above that level will point to more upside, potentially to the all-time high of $212.

However, the bullish outlook will become invalid if the stock moves below the lower side of the wedge pattern, which will point to more downside, potentially to the psychological level at $150.

Nvidia shares have become a bargain

The recent Nvidia stock price pullback has been triggered by the rising risks of competition from American and Asian companies.

Most importantly, there are concerns that Google will become a major player in the GPU industry if it starts selling its chips to other companies, including the likes of Meta Platforms.

OpenAI is also building its chips using Broadcom, a company whose market capitalization has jumped to over $1.7 trillion.

Other competition is coming from China, where companies like Alibaba and SMOC are building their own chips. Just today, Moore Threads, a Chinese competitor, soared by over 500% after going public.

However, these fears seem to be exaggerated as Nvidia has more years of experience in the industry, meaning that it may continue being the most dominant player in the industry.

A good example of this is the fact that its growth has continued despite the soaring competition from AMD, which has developed GPUs that are almost as good as those made by Nvidia.

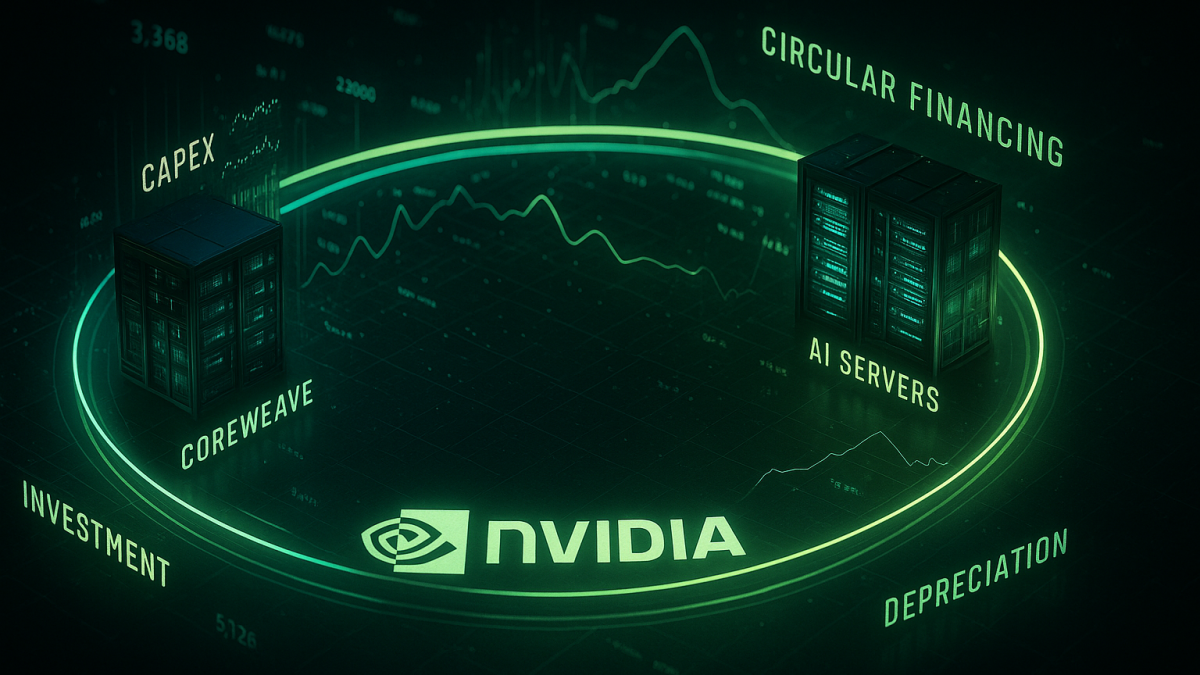

Nvidia stock price has also struggled as investors have remained concerned about the AI bubble and its circular investing approach, where it invests in companies that then use the money to buy its chips.

Still, the current data shows that Nvidia is doing well, with its revenue growth accelerating. Its most recent results showed that its revenue rose to over $55 billion, and the management believes that the fourth quarter will hit $65 billion.

Nvidia is also one of the most profitable companies in Wall Street, with its profit margins being 53%, higher than AMD’s 10% and Micron’s 23%. Palantir, a software maker, has a net profit margin of 28%.

Still, despite these numbers, Nvidia has a forward PE ratio of 38, much lower than the five-year average of 45%. It also has forward PEG ratio of 1.03, much lower than the sector median of 1.72%.

Nvidia has one of the best rule-of-40 metrics in Wall Street. It has a forward revenue growth of 65% and a net income margin of 53%, giving it a multiple of 118%. While the rule-of-40 largely applies to SaaS companies, Nvidia’s numbers show how strong it is today.

Therefore, Nvidia has numerous technical and fundamental catalysts that will likely help its stock recover and possibly blast past its all-time high.

The post Nvidia stock price is a $4.6 trillion bargain: here’s why it may soar appeared first on Invezz